NPS has been an invaluable model that has offered one of the most simple, effective, and standardized metrics that plays an important role in how many organizations measure their performance in both B-to-B and B-to-C environments. Its simplicity has played a key part of its adoption; a model based on a single question, “How likely is it that you would recommend this company to a friend or colleague?”. For the first two and half decades in our 30 years in market research and behavioural modeling, if asked what is the one question that encapsulates best our performance and brand imprint, the answer to our partners was that question, propensity to recommend. Today, our answer is different.

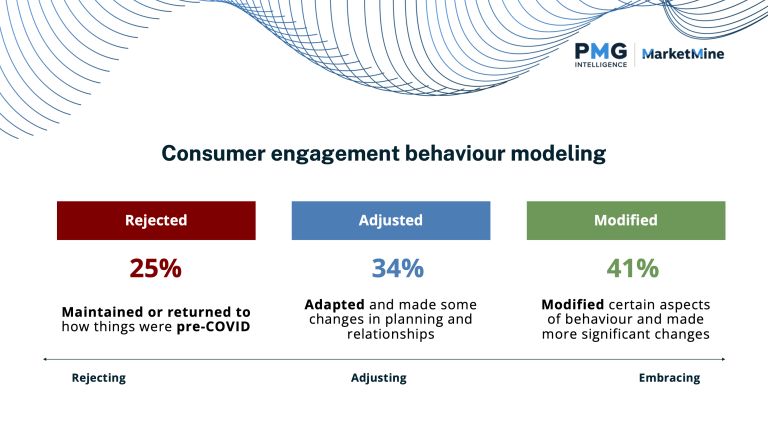

Market and behavioural dynamics have fundamentally changed over the past 5 years and are shifting how customers value their professional relationships and their willingness to change or add new partners. COVID has impacted switch rates where the inconvenience of switching service/product providers and professional relationships pre-COVID was a barrier to change.

Today, the stressors the pandemic created (financial, social, health) have fundamentally reduced the aversion to change or do something that was, in the past, inconvenient. This impacts the relevance of and how NPS and other performance measurement models are used. And, as market and behavioural dynamics alter, so too is the need for more advanced metrics that measure and track performance.

There are many factors that inform the relevance, role, and efficacy of using promoter indexes. First, how does it connect to the problem we are trying to solve, the opportunity we are trying to capitalize on, and how effectively does it provide a measure of our performance. At an operational level, is it the appropriate metric to inform how we are progressing on our strategy, and does it belong on our balanced scorecard?

A common question we are asked is the reliability of using NPS as a tracking index against acquisition and retention initiatives. It’s a great question. NPS is a sentiment measurement that offers reliability of a customer’s feelings, most closely connected to their satisfaction at a specific moment in time. As an indicator of longevity or defection risk, today, it is less reliable than in the past.

Be aware of the false positive. With the increase in consumers’ willingness to accept counter offers and expand to include more non-primary product and service providers, the correlation between stated likelihood to recommend and their switch behaviour has declined.

An example of this would be in financial services and insurance where we are observing above average satisfaction scores and at the same time seeing lower relationship to loyalty. In these sectors, a part of this is due to the lower frequency of human interactions where even though an above average score exists and the client really likes you, it doesn’t mean that they won’t leave you or move you to non-primary because the process of switching is not a barrier like it used to be.

As an acquisition performance metric, like the sentiment question itself, it is best used to measure the performance of referral program initiatives. As a measurement to be used to forecast or project revenue or acquisition growth, it is challenged depending on industry. In B-to-C applications, there is a segment of people who generally do not refer, regardless of their satisfaction, and more so post-COVID, sole-sentiment metrics are growingly an ineffective indicator of behaviour.

Using only one question today as the performance metric doesn’t service the outcomes of shifting market behaviour. Over the past 5 years, our firm has been studying the impact of performance features on retention and acquisition. There are four markers that when combined algorithmically more effectively connect to the behaviour of referring, switching, joining, and share of wallet. These markers, in addition to the NPS metric of likelihood to recommend, are confidence, satisfaction, and likelihood to stay. Importantly, the confidence measurement and its relevance is growing statistically speaking on the impact it has on scoring the health of the client relationship and its effect on both retention and acquisition.

The good news is that in the past 30 years, we have not observed increases in client engagement like we are seeing today, which creates new pathways to deepen existing relationships and open the doors to fostering new ones.