‘Segmentation’ is an overused word in research and generally refers to simple crosstabs that compare data by geography, gender, or other demographic variables. However, segmentation can be a powerful tool when executed with advanced analysis to identify unique, homogenous groups that provide a deeper understanding of your markets and the factors that drive their perceptions and behaviours.

When done effectively, segmenting your clients has many benefits, including developing more targeted and customized communications and campaigns, improving the client experience, shortening the sales cycles, and positively impacting your share of wallet. An effective segmentation can provide your firm with the information required to have a meaningful influence on client behaviours, perceptions, and financial outcomes.

For nearly 30 years, PMG Intelligence has built a reputation for delivering deeper insights to Canada’s financial services and insurance industry. One area we will review today is how PMG’s proprietary Life Stage Segmentation model can help you to activate your current client base.

Challenges with segmentation

The ability to segment clients is an important tool for firms in managing their clients’ experience. Client segmentation helps to support engagements to be more personalized and customized to their circumstances and needs, and in a more digitized world, every engagement counts. While segmentation can be a powerful tool, not all segmentation approaches are created equally, and you can encounter challenges if a model doesn’t fit your specific needs or allow activation within your current processes.

As segmentation effectively involves putting a “label” on clients based on shared attributes, if the identified segment does not resonate (or is not intuitive) with those involved in relationship management, the segmentation model may lose credibility. Moreover, client segmentation is only as good as the activation plans that are implemented. The challenge with many client segmentation models is it is not always clear how the segmented insights can be used to drive outcomes like leads, referrals, or next best offers. And even if it is clear, it is not always easy to implement depending on what is required to apply the segmentation to your client database. If the client segmentation model doesn’t lend itself to activation, it is likely to be ineffective and may lose credibility.

PMG’s Life Stage Segmentation Modeling

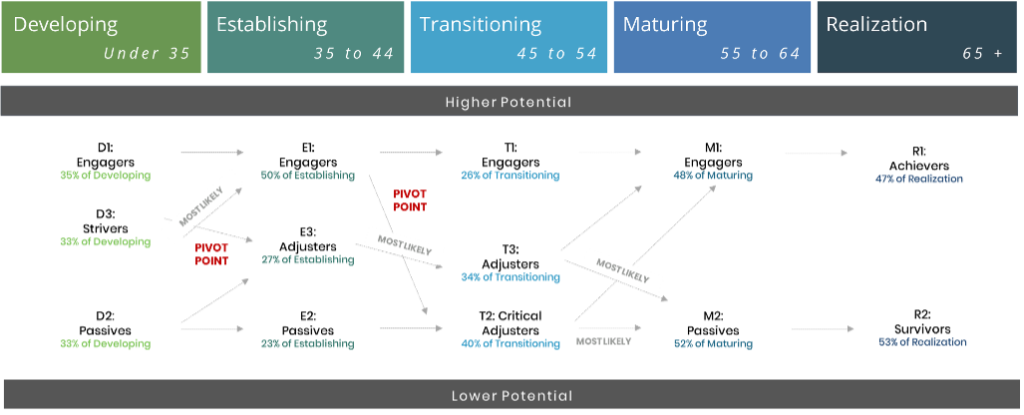

Here at PMG, we have developed and refined a proprietary Life Stage Segmentation (LSS) Model that identifies 13 homogenous segments over five distinct life stages based on a client’s personal circumstance and how they approach money and financial advice. It is designed and built for the financial services industry and provides insights into the key opportunities — and how to connect — with each segment to deepen your relationships, and in turn, have a positive impact on share of wallet.

Connecting the segmentation to life stage is particularly helpful within financial services and naturally aligns with the needs, opportunities, and challenges that vary as clients work through each stage of life. It also accounts for the natural progression of the client through life and has the flexibility to account for changing needs over time. This has the benefit of making the model more intuitive and easier to implement at all levels of an organization.

Figure 1 outlines PMG’s LSS model with the five overarching life stages across the top, and the specific segments that are contained within each life stage below. You can see how individuals transition through life and the various segments as well as defined pivot points that offer the greatest opportunities to impact their trajectory to financial success.

There are some consumers who tend to have more financial acumen early in life, which stays with them throughout their lifetime. Recognizing and delivering on their more sophisticated needs is key. Other people don’t have the necessary financial skills and experience, but with some help, they can be more financially successful. This means, as an industry, there are opportunities to intervene and have a decided impact on a client’s financial outcome.

Figure 1:

The model is compelling because of its simplicity. This simplicity increases the likelihood of personnel connecting with the segmentation while also being granular enough to account for the nuances and changes most (if not all) of us will experience throughout the course of our lives.

How do you activate?

A key outcome with PMG’s Life Stage Segmentation model is its connection to advice and specifically to PMG’s Value of Advice (VOA) factors to help individuals maximize their financial outcomes throughout each stage of life. PMG has statistically proven the application of the Value of Advice factors as a pathway to improving financial outcomes for consumers. From an advisor and firm perspective, PMG’s VOA factors represent a “blueprint” for financial advice that can be applied to each of PMG’s Life Stage Segments. It is a guide to supporting financially successful outcomes throughout a client’s financial life.

To further support marketing activation, PMG has also developed detailed personas or “playbooks” that describe each of the 13 sub-segments, outlines their primary advice needs, and gives insights into how to approach these segments to improve their financial picture and, in turn, your business results.

Through predictive analytics and machine learning, we have an ability to segment a client database into one of the 13 segments, without the need for additional surveying. These insights can be directly integrated into your CRM environment to create synergies in the efficiencies of existing relationship management tools.

Pulling it all together

An effective client segmentation model is an important element to consider in supporting a firm’s strategy. PMG has developed a Life Stage Segmentation model specifically for the financial services industry that has been thoughtful in addressing the inherent challenges of building and using a client segmentation model. Most importantly, it can be a part of an activation strategy that connects client segmentation to key advice factors that will improve financial outcomes for your clients, maximize the client experience, shorten sales cycles, and have a positive impact on increasing cross-sell and/or share of wallet.

Published by PMG Intelligence