In today’s business, increasing share of wallet and cross-sell opportunities are key business priorities for many advisors and financial services executives. These objectives are typically achieved through understanding and meeting your clients’ needs across multiple products and services.

For nearly 30 years, PMG has built a reputation for delivering deeper insights to Canada’s financial services and insurance industry. One area we will discuss today is how data science can improve the value of advice which, in turn, can increase share of wallet and cross-sell opportunities with your current clients.

Over the last 6 years PMG has been studying financial consumers to understand and quantify how firms and advisors can influence the value of advice. Our team has done this by capturing and aggregating data that assesses more than 100 advice factors, ranging from the financial basics (e.g., expense management) through more complex planning considerations (e.g., how asset allocation impacts the value of investments). Using data science and advanced data analytics, PMG has statistically quantified how these factors, when applied, can increase a consumers’ financial success.

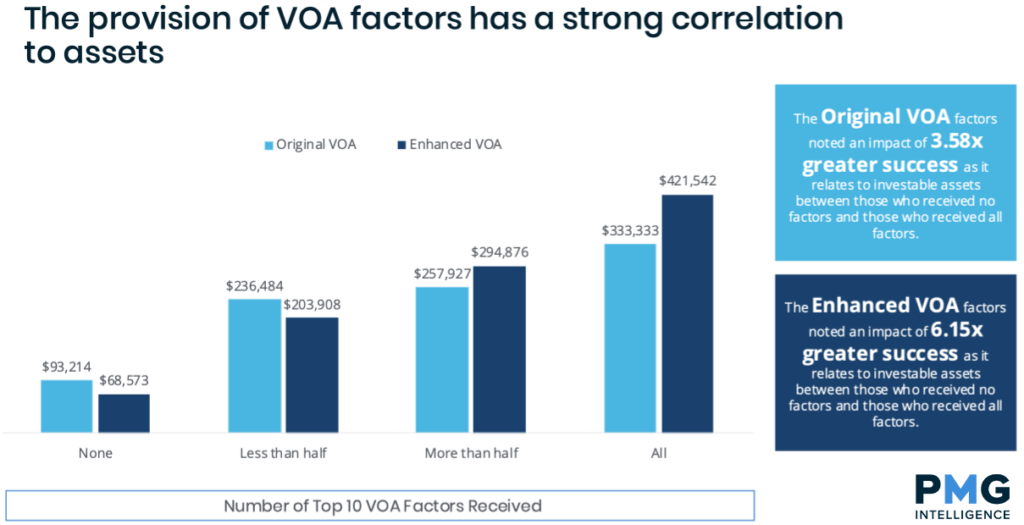

As seen in Figure 1, when clients receive the top 10 Value of Advice (VOA) factors (identified from more than 100 that were tested), they are 6.15x more successful in accumulating assets.

Figure 1

It is not surprising to see the positive impact of receiving financial advice. What may be surprising are the advice factors that have been identified by PMG’s data science team as being most important to prioritize.

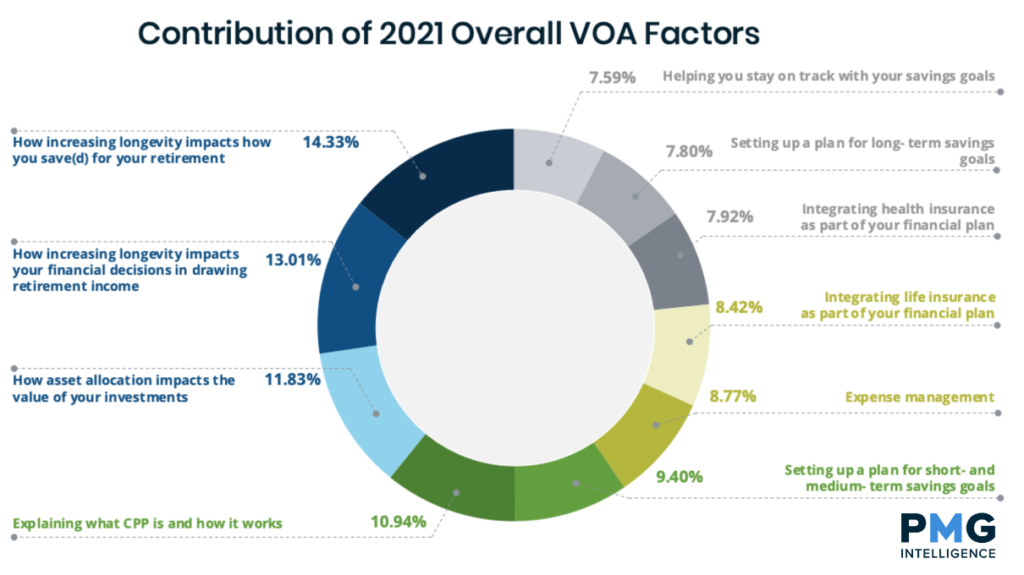

Figure 2 identifies the top 10 VOA factors that contribute to financial success overall, regardless of specific life stage. It is encouraging to see things like understanding the impact of longevity in retirement planning, managing expenses, and the importance of insurance planning rise to the top as contributors.

This data also marks a behavioural shift in the engagement of Canadian consumers when compared to 2019 (pre-COVID) where advice on expense management was noted as the highest contributor to financial health and success. Today, financial consumers are wanting greater engagement in retirement planning at a younger age, are more open to discussing product and its application in growing wealth (and producing income), and are looking to be more active in the advice relationship.

Figure 2

Recognizing that consumers vary in their financial needs and goals throughout life, PMG applied their proprietary Life Stage Segmentation model to identify the top VOA Factors that have the greatest impact on fostering successful financial outcomes at each stage.

As expected, differences are noted in which factors are deemed most important to prioritize through each life stage. For example, understanding CPP shows up for those consumers under 35 where understanding how payroll deductions work is connected to fostering their engagement and, in turn, an upward financial trajectory. This factor also shows up for those over 65 as they need to know how, and when, to trigger CPP and how it connects to retirement income planning.

Key takeaway

Using data science and advanced data analytics, PMG has statistically proven the application of the Value of Advice factors as a pathway to achieving your goals for increasing share of wallet and cross-sell opportunities.

From an advisor and firm perspective, PMG’s VOA factors represent a “blueprint” for financial advice. It is a guide to supporting financially successful outcomes throughout a client’s financial life. Beyond increased success for clients, effective advice and planning supported by PMG’s insights help to further foster trust and improve success – for the client, the advisor, and the firm.

Published by PMG Intelligence